Estate Planning Attorney Can Be Fun For Everyone

Table of ContentsEstate Planning Attorney Can Be Fun For AnyoneThe Definitive Guide for Estate Planning AttorneyEstate Planning Attorney Things To Know Before You Get ThisThe Facts About Estate Planning Attorney Revealed

Estate preparation is an activity strategy you can make use of to establish what takes place to your assets and obligations while you live and after you pass away. A will, on the various other hand, is a lawful record that outlines how assets are distributed, that takes treatment of children and pets, and any various other dreams after you pass away.

Cases that are rejected by the executor can be taken to court where a probate judge will have the final say as to whether or not the claim is legitimate.

Little Known Facts About Estate Planning Attorney.

After the supply of the estate has been taken, the worth of assets calculated, and taxes and debt repaid, the administrator will certainly then seek authorization from the court to disperse whatever is left of the estate to the recipients. Any type of estate tax obligations that are pending will come due within 9 months of the date of death.

Each specific areas their properties in the trust fund and names a person apart from their partner as the beneficiary. A-B counts on have become much less preferred as the inheritance tax exception works well for a lot of estates. Grandparents might move properties to an entity, such as a 529 strategy, to support grandchildrens' education.

The Buzz on Estate Planning Attorney

Estate organizers can collaborate with the benefactor in order to decrease gross income as an outcome of those contributions or develop approaches that optimize the result of those donations. This is an additional approach go to website that can be used to restrict death taxes. It entails a private securing in the current value, and hence tax responsibility, of their residential property, while attributing the value of future development of that funding to an additional person. This approach involves freezing the worth of a property at its value on the date of transfer. As necessary, the amount of prospective resources gain at death is likewise iced up, permitting the estate planner to approximate their potential tax obligation upon fatality and far better plan for the repayment of revenue taxes.

If adequate insurance earnings are offered and the plans are effectively structured, any income tax obligation on the deemed dispositions of possessions complying with the fatality of a person can be paid without considering the sale of properties. Proceeds from life insurance coverage that are gotten by the recipients upon the fatality of the guaranteed are normally revenue tax-free.

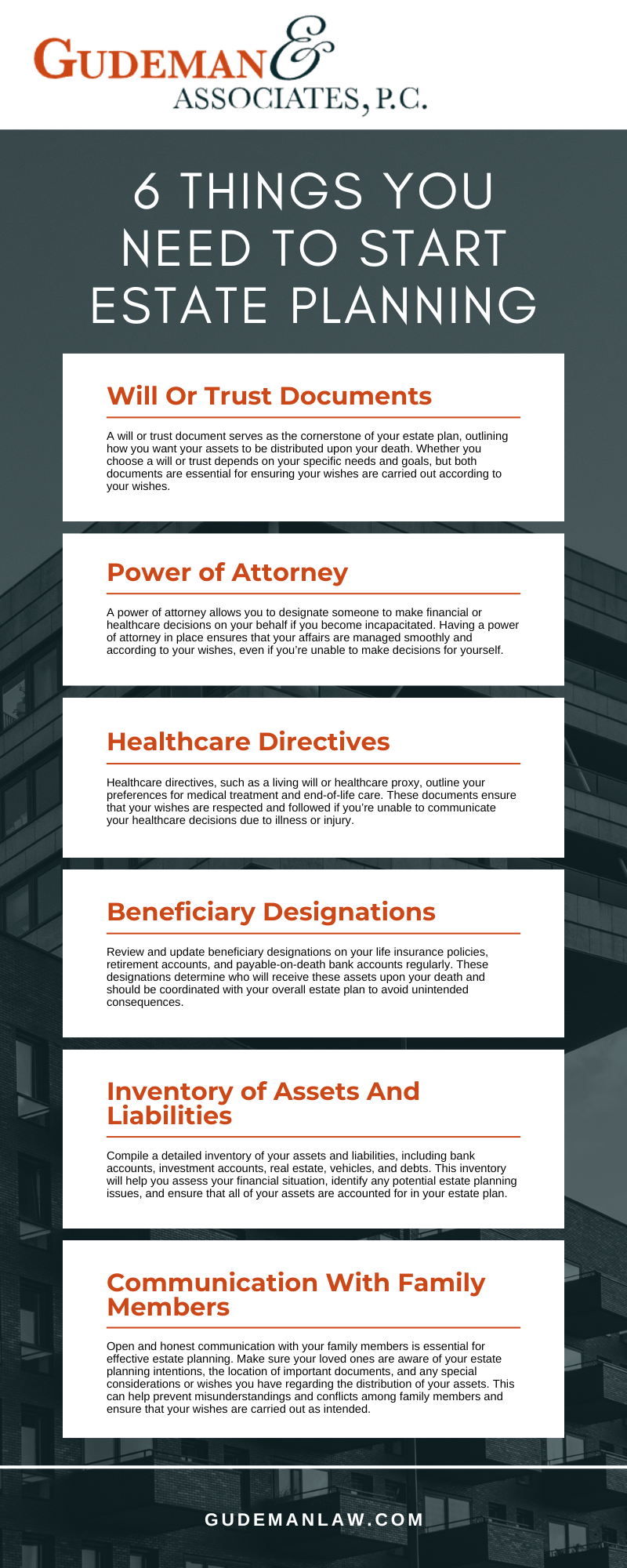

There are particular records you'll require as component of the estate preparation process. Some of the most typical ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is only for high-net-worth individuals. That's not real. As a matter of fact, estate preparation is a tool that everybody can utilize. Estate preparing makes it much easier for individuals to determine their dreams prior to and after they die. Contrary to what most individuals believe, it extends past what to do with assets and obligations.

Not known Details About Estate Planning Attorney

You must begin planning for your estate as quickly as you have any measurable property base. It's an ongoing procedure: as life progresses, your estate plan must shift to match your circumstances, in accordance with your new goals. And maintain it. Not doing your estate planning can trigger excessive economic concerns to enjoyed ones.

Estate planning is commonly thought of as a tool for the rich. However that isn't the situation. It can be a useful means for you to deal with your assets and obligations prior to and after you pass away. Estate preparation is likewise a great method for over at this website you to outline prepare for the treatment of your small youngsters and pet dogs check that and to detail your yearn for your funeral service and favorite charities.

Eligible applicants who pass the test will be officially certified in August. If you're eligible to rest for the exam from a previous application, you might submit the brief application.